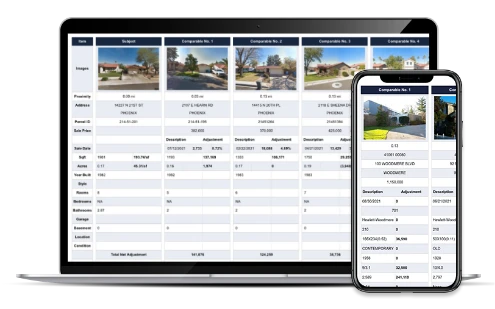

ATTOM’s Property Reports include the ability to find and filter comps—including private sales— based on location, date, price, and and a range of property attributes.

Sign Up NowProperty Report for 1010 E Ewing Ave, South Bend, IN 46613

Find Comparables

- Property Address 1010 E Ewing Ave, South Bend, IN 46613

- County St. Joseph

- Parcel ID 71-08-24-230-003.000-026

- Legal description LOT 10 CHARLES WEIDLERS 1ST ADD

- School district South Bend Community School Corporation

- Acreage 0.12

- Property class Single Family Residence

- Zoning Subscribe

- Square footage 1,344

- Year built 1924

- Bedrooms 3

- Bathrooms 1

About the Property

1010 E Ewing Ave is a single family residence in the city of South Bend, IN 46613. Located in the South Bend Community School Corporation, which resides in St. Joseph County, IN and built in 1924. This Single Family Residence sits on a 5,307 sq ft lot and features 3 bedrooms, 1 bathrooms and 1,344 sq ft of living space.

The most recent property tax for 1010 E Ewing Ave was $1,593 with an estimated market value range of $164,158 to $167,475. This property was last sold on April 13, 2017 for $76,312.

Property Info

Sign up to see full Property Info for 1010 E Ewing Ave, South Bend

- LOT 10 CHARLES WEIDLERS 1ST ADD

- Classification SINGLE FAMILY RESIDENCE

- County ST. JOSEPH

- FIPS 18141

- Civil Division PORTAGE

- Census 181410033.001001

- Parcel ID 71-08-24-230-003.000-026

- Neighborhood CHARLES WEIDLERS 1ST ADD

- Tract 0

- Secondary School District N/A

- Primary School District South Bend Community School Corporation

- Acres 0.12

- Square Feet 5,307

- Units N/A

- Year Built 1924

- Effective Year Built N/A

- Stories 2

- # Fireplaces N/A

- Garage/Carport N/A

- Cooling Central

- Heating Central

- Square Footage

- Living Area 1,344

- Total Rooms 4

- Bedrooms 3

- Total Bathrooms 1

- Full Bathrooms 1

South Bend Residential Market Stats

See more Real Estate Trends for South Bend including home values, types of properties sold and transaction volumes.

Taxes and Assessments for 1010 E Ewing Ave, South Bend

| Tax Year | Taxes | Tax Assesed Value | Exemptions |

|---|---|---|---|

| 2024 | $1,593 (+12.8%) | $134,100 (+13.6%) | |

| 2023 | $1,412 (+24.8%) | $118,000 (+21.8%) | |

| 2022 | $1,132 (+24.9%) | $96,900 (+5.9%) | |

| 2021 | |||

| 2020 | |||

| 2019 | |||

| 2018 |

Sales History for 1010 E Ewing Ave, South Bend

| Sale Date | Recorded Date | Buyer(s) | Seller(s) | Price | Document ID |

|---|---|---|---|---|---|

| Address | Distance | SqFt | Sale Date | Price | $/SqFt |

|---|---|---|---|---|---|

| 3322 WHITCOMB AVE | .93 mi | 1,328 | 08/20/2025 | $97,000 | $73 |

| 1630 S SCOTT ST | 1.23 mi | 1,248 | 08/20/2025 | $81,000 | $65 |

| 533 ALTGELD ST | .36 mi | 1,488 | 08/19/2025 | $205,313 | $138 |

Sign up to access

- 1. South Bend

- 2. Notre Dame

- 3. Mishawaka

- 4. Granger

- 5. Osceola

- 6. Wyatt

Various data sets have been provided by a third party or government source and are subject to change and possible errors. Depending on location and source, data may be missing or not available. Information is deemed reliable but not guaranteed to be accurate, up-to-date, or complete. Buyers, investors, and others are responsible for verifying the accuracy of all information.