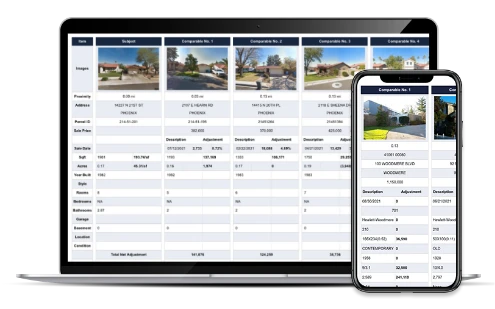

ATTOM’s Property Reports include the ability to find and filter comps—including private sales— based on location, date, price, and and a range of property attributes.

Sign Up NowProperty Report for 5533 S 1000 E, Grammer, IN 47236

Find Comparables

- Property Address 5533 S 1000 E, Grammer, IN 47236

- County Bartholomew

- Parcel ID 03-87-11-320-000.200-017

- Legal description LOTS 1 & 2 - JOHN L REDDS ADDITION TO GRAMMER (C/82)

- School district Bartholomew County School Corporation

- Acreage 0.37

- Property class Single Family Residence

- Zoning Subscribe

- Square footage 872

- Year built 1985

- Bedrooms 2

- Bathrooms 1

About the Property

5533 S 1000 E is a single family residence in the city of Grammer, IN 47236. Located in the Bartholomew County School Corporation, which resides in Bartholomew County, IN and built in 1985. This Single Family Residence sits on a 15,960 sq ft lot and features 2 bedrooms, 1 bathrooms and 872 sq ft of living space.

The most recent property tax for 5533 S 1000 E was $1,490 with an estimated market value range of $101,375 to $112,046. This property was last sold on April 12, 2018 for $29,106.

Property Info

Sign up to see full Property Info for 5533 S 1000 E, Grammer

- LOTS 1 & 2 - JOHN L REDDS ADDITION TO GRAMMER (C/82)

- Classification SINGLE FAMILY RESIDENCE

- County BARTHOLOMEW

- FIPS 18005

- Civil Division ROCK CREEK

- Census 180050113.004017

- Parcel ID 03-87-11-320-000.200-017

- Neighborhood GRAMMER JOHN L REDD ADD

- Tract 0

- Secondary School District N/A

- Primary School District Bartholomew County School Corporation

- Acres 0.37

- Square Feet 15,960

- Units N/A

- Year Built 1985

- Effective Year Built N/A

- Stories 1

- # Fireplaces N/A

- Garage/Carport N/A

- Cooling N/A

- Heating Central

- Square Footage

- Living Area 872

- Total Rooms 4

- Bedrooms 2

- Total Bathrooms 1

- Full Bathrooms 1

Grammer Residential Market Stats

See more Real Estate Trends for Grammer including home values, types of properties sold and transaction volumes.

Taxes and Assessments for 5533 S 1000 E, Grammer

| Tax Year | Taxes | Tax Assesed Value | Exemptions |

|---|---|---|---|

| 2023 | $1,490 (+59.4%) | $62,800 (+4.1%) | |

| 2022 | $934 (-4.3%) | $60,300 | |

| 2020 | $976 (+45.8%) | $60,300 (-0.5%) | |

| 2019 | |||

| 2018 | |||

| 2017 | |||

| 2016 |

Sales History for 5533 S 1000 E, Grammer

| Sale Date | Recorded Date | Buyer(s) | Seller(s) | Price | Document ID |

|---|---|---|---|---|---|

Sign up to access

- 1. Grammer

- 2. Elizabethtown

- 3. Hartsville

- 4. Scipio

- 5. Westport

- 6. Hope

Various data sets have been provided by a third party or government source and are subject to change and possible errors. Depending on location and source, data may be missing or not available. Information is deemed reliable but not guaranteed to be accurate, up-to-date, or complete. Buyers, investors, and others are responsible for verifying the accuracy of all information.